All Categories

Featured

Table of Contents

At The Annuity Expert, we recognize the intricacies and emotional tension of preparing for retired life. You wish to guarantee economic safety and security without unneeded risks. We've been guiding customers for 15 years as an insurance coverage company, annuity broker, and retirement planner. We stand for finding the very best remedies at the lowest expenses, guaranteeing you get one of the most value for your financial investments.

Whether you are risk-averse or looking for greater returns, we have the competence to guide you via the nuances of each annuity kind. We identify the stress and anxiety that features financial unpredictability and are here to use clearness and confidence in your financial investment decisions. Begin with a totally free assessment where we analyze your monetary goals, threat tolerance, and retirement requirements.

Shawn is the creator of The Annuity Professional, an independent online insurance policy firm servicing consumers throughout the United States. Via this system, he and his team purpose to eliminate the guesswork in retired life planning by helping individuals discover the ideal insurance protection at the most competitive prices. Scroll to Top.

Analyzing Strategic Retirement Planning A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Pros and Cons of Fixed Annuity Vs Variable Annuity Why Fixed Vs Variable Annuity Pros Cons Matters for Retirement Planning Retirement Income Fixed Vs Variable Annuity: How It Works Key Differences Between Different Financial Strategies Understanding the Rewards of Choosing Between Fixed Annuity And Variable Annuity Who Should Consider Pros And Cons Of Fixed Annuity And Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Pros And Cons Of Fixed Annuity And Variable Annuity Common Mistakes to Avoid When Choosing Variable Annuities Vs Fixed Annuities Financial Planning Simplified: Understanding Variable Annuities Vs Fixed Annuities A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

This costs can either be paid as one lump sum or dispersed over a period of time., so as the value of your agreement grows, you will not pay taxes up until you get revenue settlements or make a withdrawal.

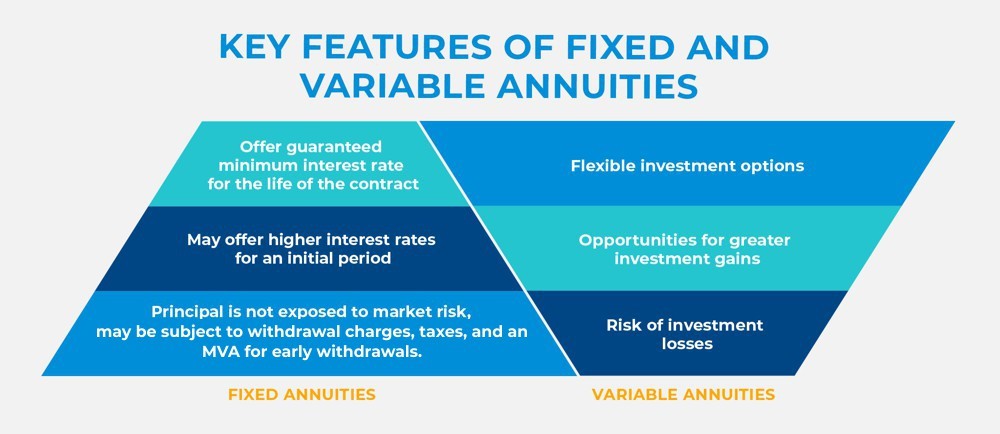

Regardless of which choice you make, the cash will be rearranged throughout your retired life, or over the duration of a chosen amount of time. Whether a round figure settlement or a number of premium settlements, insurer can provide an annuity with a collection rate of interest price that will certainly be credited to you in time, according to your agreement, called a fixed price annuity.

Highlighting Fixed Index Annuity Vs Variable Annuity A Closer Look at Fixed Income Annuity Vs Variable Growth Annuity What Is Annuity Fixed Vs Variable? Pros and Cons of Fixed Vs Variable Annuity Pros And Cons Why Choosing the Right Financial Strategy Is a Smart Choice Pros And Cons Of Fixed Annuity And Variable Annuity: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Fixed Annuity Vs Variable Annuity Who Should Consider Fixed Income Annuity Vs Variable Growth Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Annuity Fixed Vs Variable A Beginner’s Guide to What Is A Variable Annuity Vs A Fixed Annuity A Closer Look at How to Build a Retirement Plan

As the value of your repaired price annuity expands, you can remain to live your life the method you have actually constantly had actually planned. There's no need to stress and anxiety over when and where money is coming from. Repayments correspond and assured. Make certain to seek advice from your economic expert to identify what type of fixed rate annuity is appropriate for you.

This provides you with ensured revenue earlier instead than later on. Nevertheless, you have alternatives. For some the prompt option is a required selection, but there's some adaptability below as well. While it may be made use of instantly, you can additionally delay it for up to one year. And, if you postpone, the only section of your annuity considered gross income will be where you have accrued rate of interest.

A deferred annuity permits you to make a swelling amount settlement or numerous payments in time to your insurance provider to supply revenue after a set period. This duration allows for the rate of interest on your annuity to expand tax-free prior to you can accumulate settlements. Deferred annuities are normally held for about 20 years prior to being qualified to obtain settlements.

Breaking Down Your Investment Choices A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Features of Annuities Fixed Vs Variable Why Tax Benefits Of Fixed Vs Variable Annuities Can Impact Your Future How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Annuity Or Variable Annuity FAQs About Variable Annuities Vs Fixed Annuities Common Mistakes to Avoid When Choosing Fixed Index Annuity Vs Variable Annuities Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Annuities Variable Vs Fixed

Since the rate of interest is dependent upon the efficiency of the index, your cash has the chance to expand at a different rate than a fixed-rate annuity. With this annuity plan, the rates of interest will certainly never be less than zero which suggests a down market will certainly not have a considerable adverse influence on your income.

Just like all financial investments, there is potential for threats with a variable price annuity. There is also excellent prospective for growth that might provide you with needed versatility when you start to obtain payouts. Annuities are a superb means to obtain a "retirement paycheck" when you select to settle at the end of your occupation.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices Key Insights on Your Financial Future Defining Fixed Annuity Or Variable Annuity Features of Fixed Income Annuity Vs Variable Growth Annuity Why Fixed Vs Variable

Best Place To Buy An Annuity

Aig Annuity Safety

More

Latest Posts

Best Place To Buy An Annuity

Aig Annuity Safety